Taxation / Form 8858: Everything You Need to Know

Form 8858: Everything You Need to Know

Key Takeaways

This is a Complete Guide for US Taxpayers with Foreign Disregarded Entities

- Who needs to file Form 8858? US individuals, corporations and partnerships with a foreign disregarded entity (FDE) or foreign branch (FB) must report their financial details to the IRS.

- What happens if you don’t file? Failure to file can lead to $10,000 penalties, loss of foreign tax credits, and even criminal penalties for willful noncompliance.

- How can you reduce taxes? Using the Foreign Earned Income Exclusion, Foreign Tax Credit and Foreign Housing Exclusion can help lower or eliminate your US tax liability.

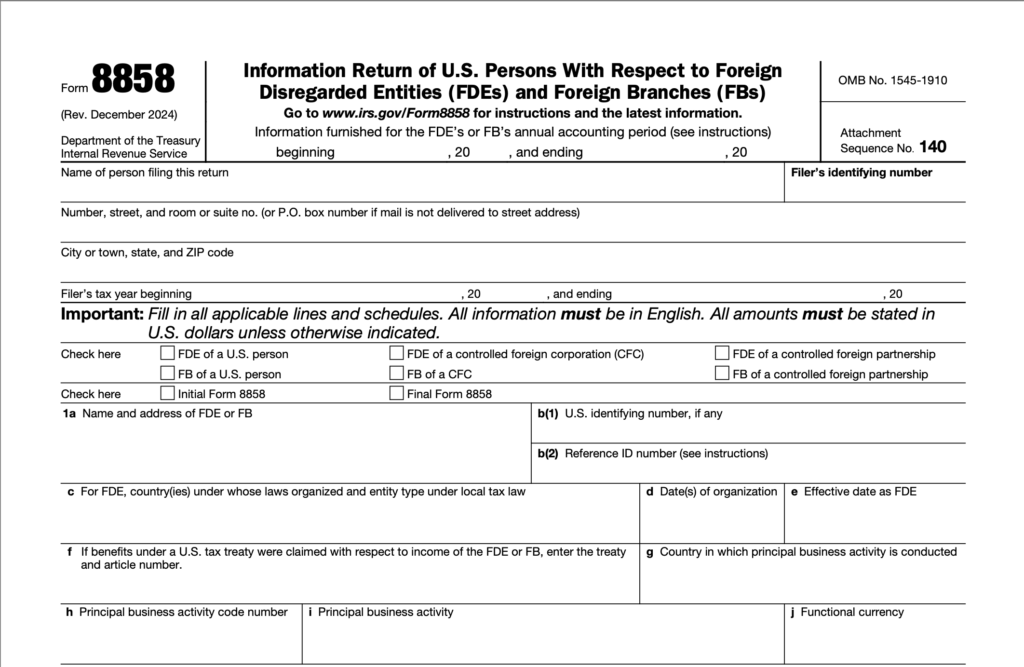

If you’re a U.S. taxpayer with business interests abroad, you will probably need to file Form 8858.

This form is used to report information on Foreign Disregarded Entities (FDEs) and Foreign Branches (FBs), ensuring compliance with IRS regulations.

Whether you directly own an FDE or operate an FB, understanding your filing obligations is absolutely crucial to avoiding penalties in the future.

What Is Form 8858?

Form 8858 is a tax form for US persons who own or run foreign disregarded entities (FDEs) or foreign branches (FBs).

It tells the IRS about income, transactions, and financial activity from these businesses abroad. The goal is to make sure everything is reported properly and to prevent tax evasion.

If you have an FDE or FB, the IRS wants to know what it earns, where the money goes, and how it

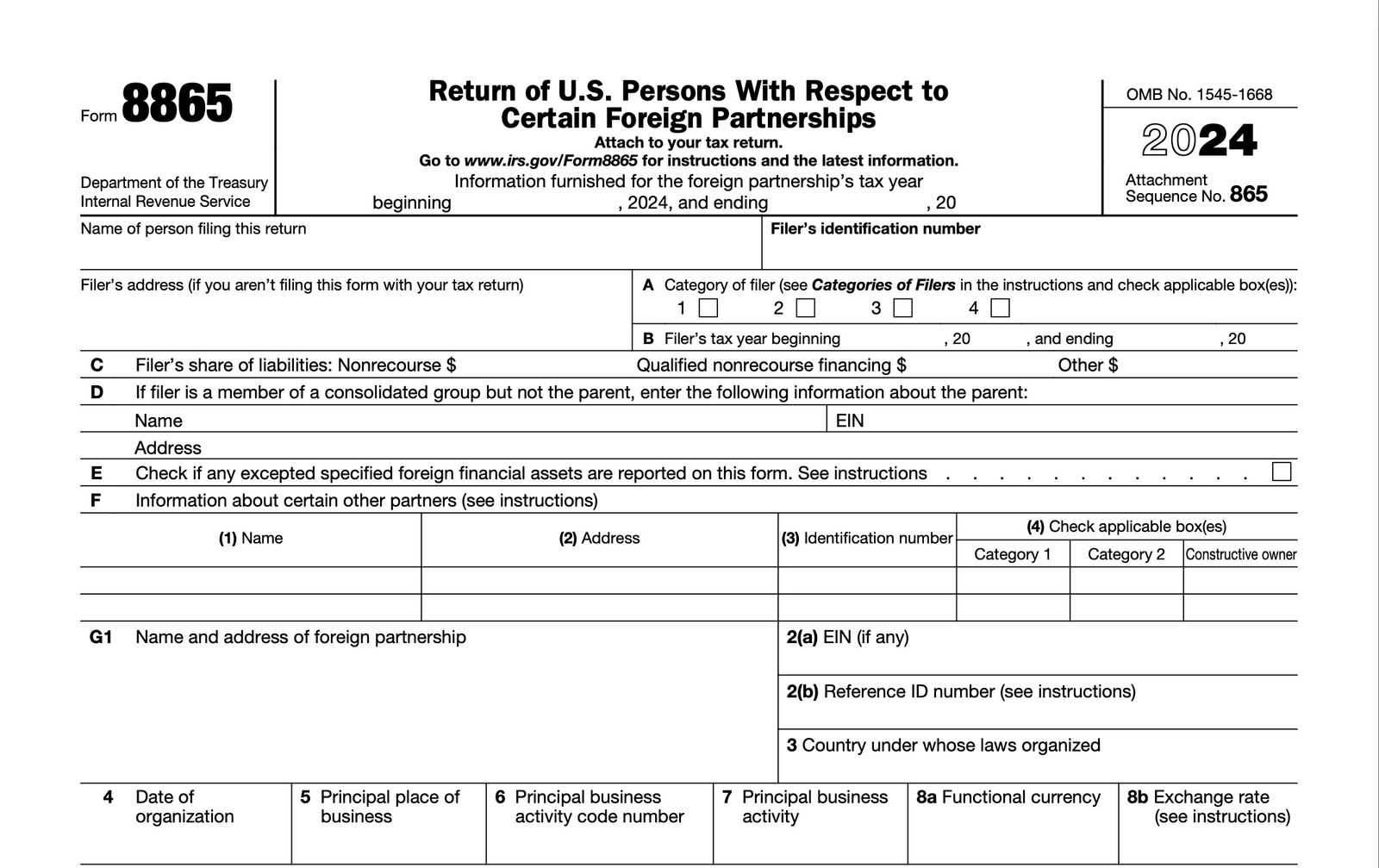

The 8858 Form is often necessary alongside other tax forms.

It is commonly submitted with Form 5471 (for Foreign Corporations) or Form 8865 (for Controlled Foreign Partnerships) when the tax owner of the FDE or FB is a Controlled Foreign Corporation (CFC) or Controlled Foreign Partnership (CFP).

If you’re unsure whether you need to file, carefully reviewing IRS Form 8858 instructions or consulting a tax professional can help you determine your obligations.

Failing to file when required can result in big IRS penalties, so it’s good to get it right from the beginning.

Who Needs to File Form 8858?

You must file Form 8858 if you are a US person who meets any of the following conditions:

- Direct Ownership – You directly own a Foreign Disregarded Entity (FDE) or operate a Foreign Branch (FB) at any time during the tax year. This means you are personally responsible for the entity’s financial activities and must report them to the IRS.

- Indirect Ownership – You indirectly own an FDE or FB through one or more tiers of foreign disregarded entities. This includes cases where your US business owns an FDE that, in turn, owns another FDE or FB.

- Filing Requirement Through a Related Entity – You are required to file Form 5471 (for foreign corporations) or Form 8865 (for controlled foreign partnerships) because the tax owner of the FDE or FB is a Controlled Foreign Corporation (CFC) or a Controlled Foreign Partnership (CFP). In this case, you must attach Form 8858 to the relevant filing and ensure compliance with IRS regulations.

Key Components of Form 8858

1. General Information

Details about the US taxpayer filing the form.

Identifying information for the foreign entity (FDE or FB).

The country where business is conducted and its principal business activity.

2. Income Statement (Schedule C)

Reports the financial activity of the FDE or FB.

Includes income, expenses, and net profit or loss in both functional currency and US dollars.

3. Balance Sheet (Schedule F)

Provides details on the assets, liabilities, and equity of the entity.

Must be reported in accordance with U.S. GAAP.

4. Transactions Between the FDE/FB and Related Parties (Schedule M)

Discloses cross-border transactions, including loans, payments, and sales.

Helps ensure proper reporting of foreign tax credits and deductions.

5. Other Reporting Requirements (Schedules G, H, and J)

Additional disclosures on foreign income taxes, tax credits, and losses.

Addresses dual consolidated losses and foreign tax credit limitations.

Recent IRS Updates to Form 8858 (2024 Changes)

The IRS revised Form 8858 instructions in December 2024, clarifying who must file and updating key reporting sections:

- New Category 1 and 2 Filers: Direct and indirect owners of FDEs/FBs must file.

- Category 6 Filer Updates: US corporations that are partners in a partnership checking box 11 (Dual Consolidated Loss) on Schedules K-2/K-3 must file.

- Principal Business Activity Code Changes: The IRS now requires a separate six-digit code entry for the entity’s primary business activity.

- Schedule G (Line 14): The IRS now includes reporting related to the Global Anti-Base Erosion (GloBE) rulesand Minimum Top-Up Taxes.

Who Is Considered a US Person for Form 8858?

The IRS defines a US person as:

- US citizens and resident aliens, including Green Card holders.

- Domestic corporations, including C-corporations and S-corporations.

- Partnerships and LLCs formed under US law.

- Domestic trusts and estates.

What if you don’t file the form?

Failing to file Form 8858 when required can lead to serious financial consequences!

The IRS imposes a $10,000 penalty per year per entity for failure to submit the form on time.

If you don’t correct the failure within 90 days of receiving an IRS notice, more penalties start accumulating at a rate of $10,000 for every 30-day period (or part thereof).

These extra penalties can reach a maximum of $50,000 per missing form, making non-compliance extremely costly.

Beyond monetary penalties, failure to properly report foreign income and transactions with an FDE or FB can trigger IRS audits, potential loss of foreign tax credits, and in extreme cases, criminal penalties for willful non-compliance.

All of this could include fines or even imprisonment if the IRS determines there was intentional fraud or concealment of offshore assets.

To avoid penalties, it’s crucial to:

✓ Confirm your filing requirements early—if you own or operate a Foreign Disregarded Entity (FDE) or Foreign Branch (FB), ensure you determine your IRS obligations before the tax filing deadline.

✓ File Form 8858 with your tax return—whether attached to Form 1040, 1120, 1065, 5471, or 8865, make sure it’s included in the correct filing.

✓ Work with a tax professional—if you’re uncertain about your obligations, consulting an international tax specialist can help minimize risks and ensure compliance with US tax laws.

Given the high penalties and strict reporting requirements, staying compliant with IRS regulations is crucial for any US person with foreign business interests.

Understanding Foreign Disregarded Entities (FDEs) and Foreign Branches (FBs)

When a US person owns or operates a business abroad, it may fall into one of two categories for tax purposes: a Foreign Disregarded Entity (FDE) or a Foreign Branch (FB). These classifications affect how income, expenses, and financial activity are reported to the IRS, particularly on Form 8858.

What Is a Foreign Disregarded Entity (FDE)?

A Foreign Disregarded Entity (FDE) is a foreign business entity that is ignored for US. tax purposes. Instead of being treated as a separate taxable entity, its income and expenses are directly reported by the owner on their US. tax return—as if the entity does not exist.

For example:

If a US corporation owns a foreign single-member LLC that is disregarded, all its income, losses, and deductions flow through to the parent company’s tax return.

The entity itself does not file its own US tax return, but transactions involving the FDE must still be properly documented and reported on Form 8858.

This structure is often used for simplified tax reporting and to avoid corporate-level taxation abroad, but it comes with compliance risks, especially if not properly reported.

What Is a Foreign Branch (FB)?

A Foreign Branch (FB) is an unincorporated business operation located outside the U.S. that is still considered part of the U.S. tax owner’s business activities. Unlike an FDE, which may have limited liability, an FB is simply an extension of a US business in another country.

Key characteristics of a Foreign Branch:

✓ No separate legal entity – It’s part of the US tax owner’s business.

✓ Profits and losses are reported on the US tax return (subject to foreign tax rules).

✓ May qualify for Foreign Tax Credits (FTC) to offset US tax liability.

✓ Subject to IRS anti-deferral rules, such as the Global Intangible Low-Taxed Income (GILTI) tax if profits are retained abroad.

For instance, if a US-based company opens a physical office in Spain, that office would likely be classified as a foreign branch rather than an FDE, because it is not structured as a separate entity.

How Do These Entities Affect Your Taxes?

Both FDEs and FBs have significant tax implications, including:

- IRS Reporting Obligations: FDEs and FBs must be reported on Form 8858, often alongside Form 5471 or Form 8865 if part of a Controlled Foreign Corporation (CFC) or Controlled Foreign Partnership (CFP).

- Foreign Tax Credit (FTC) Eligibility: Taxes paid in the foreign country may be used to reduce U.S. tax liability, but proper documentation is required.

- Income Tax Return Impacts: Since these entities flow through to the U.S. owner’s tax return, misreporting can increase audit risk and lead to penalties.

If you own or operate an FDE or FB, it’s essential to understand your tax filing requirements and ensure all transactions are accurately reported to the IRS.

When and How to File Form 8858

- Due Date: Form 8858 must be filed alongside your U.S. tax return, including any extensions.

- Where to File: Attach it to the appropriate return—either Form 1040, 1120, 1065, 8865, or 5471, depending on your filing status.

- Penalty for Failure to File: If you are required to file Form 8858 and fail to do so, the IRS can impose a $10,000 penalty per entity per year. Additional penalties apply for continued non-compliance.

Common Mistakes to Avoid When Filing Form 8858

⊗ Ignoring Filing Requirements – Even if your FDE or FB generates no income, failing to file can result in hefty criminal penalties.

⊗ Incorrect Reporting of Foreign Taxes – You may qualify for the Foreign Tax Credit, but misreporting can trigger an audit.

⊗ Not Filing for Each FDE or FB – If you own multiple foreign disregarded entities, you need to file a separate Form 8858 for each one.

⊗ Overlooking Functional Currency Rules – The IRS requires all amounts to be reported using U.S. GAAP rulesor translated into U.S. dollars using the proper exchange rate.

How a Tax Professional Can Help

Filing IRS Form 8858 can be complex, especially if you own multiple foreign entities. A tax professional can help ensure:

✓ Proper compliance with IRS foreign tax laws.

✓ Accurate reporting of balance sheets, income statements, and foreign tax credits.

✓ Minimized risk of penalties due to errors or late filing.

Final Thoughts

If you are a US person with a Foreign Disregarded Entity (FDE) or Foreign Branch (FB), filing Form 8858 is a necessary step in staying compliant with IRS rules.

With the new 2024 updates, it’s more important than ever to make sure that you file correctly and on time to not get any penalties.