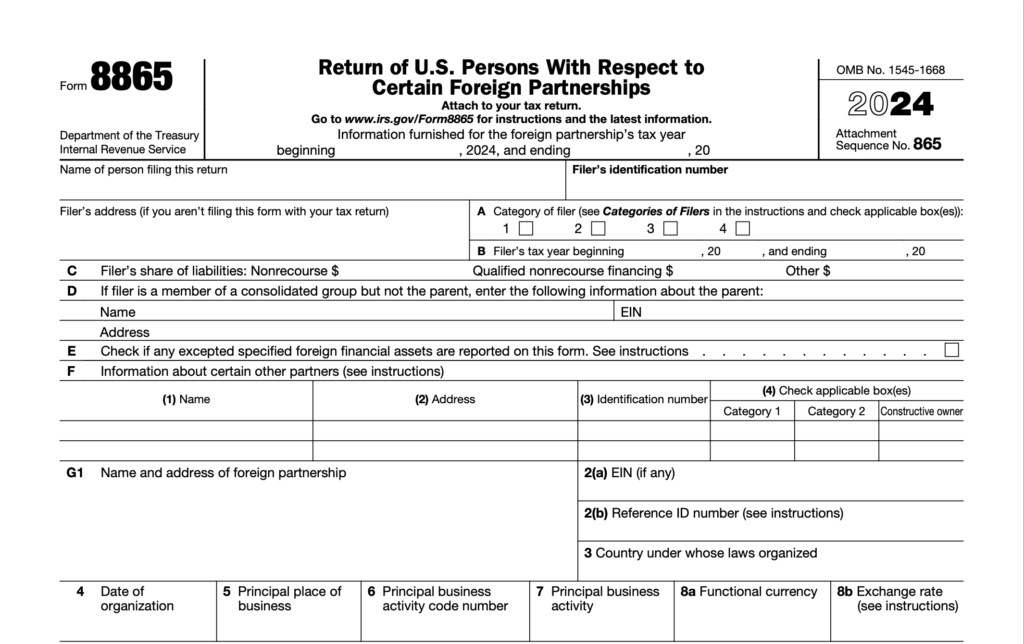

Taxation / Form 8865: Instructions & What You Need to Know

Form 8865: Instructions & What You Need to Know

Key Takeaways

- Form 8865 is required for US taxpayers with foreign partnership interests to report ownership, contributions and financial activities.

- Not filing Form 8865 can result in penalties starting at $10,000 per form, with potential fines up to $50,000 and loss of foreign tax credits.

- Knowing the filing categories and deadlines is crucial and working with a professional can help avoid mistakes, audits and costly penalties.

If you’re a US taxpayer with an interest in a foreign partnership, understanding Form 8865 is essential. This form is how the IRS tracks US taxpayers’ involvement in controlled foreign partnerships and ensures compliance with international tax laws.

In this guide, we’ll break down the filing requirements, categories of filers, potential penalties and how to avoid some common mistakes.

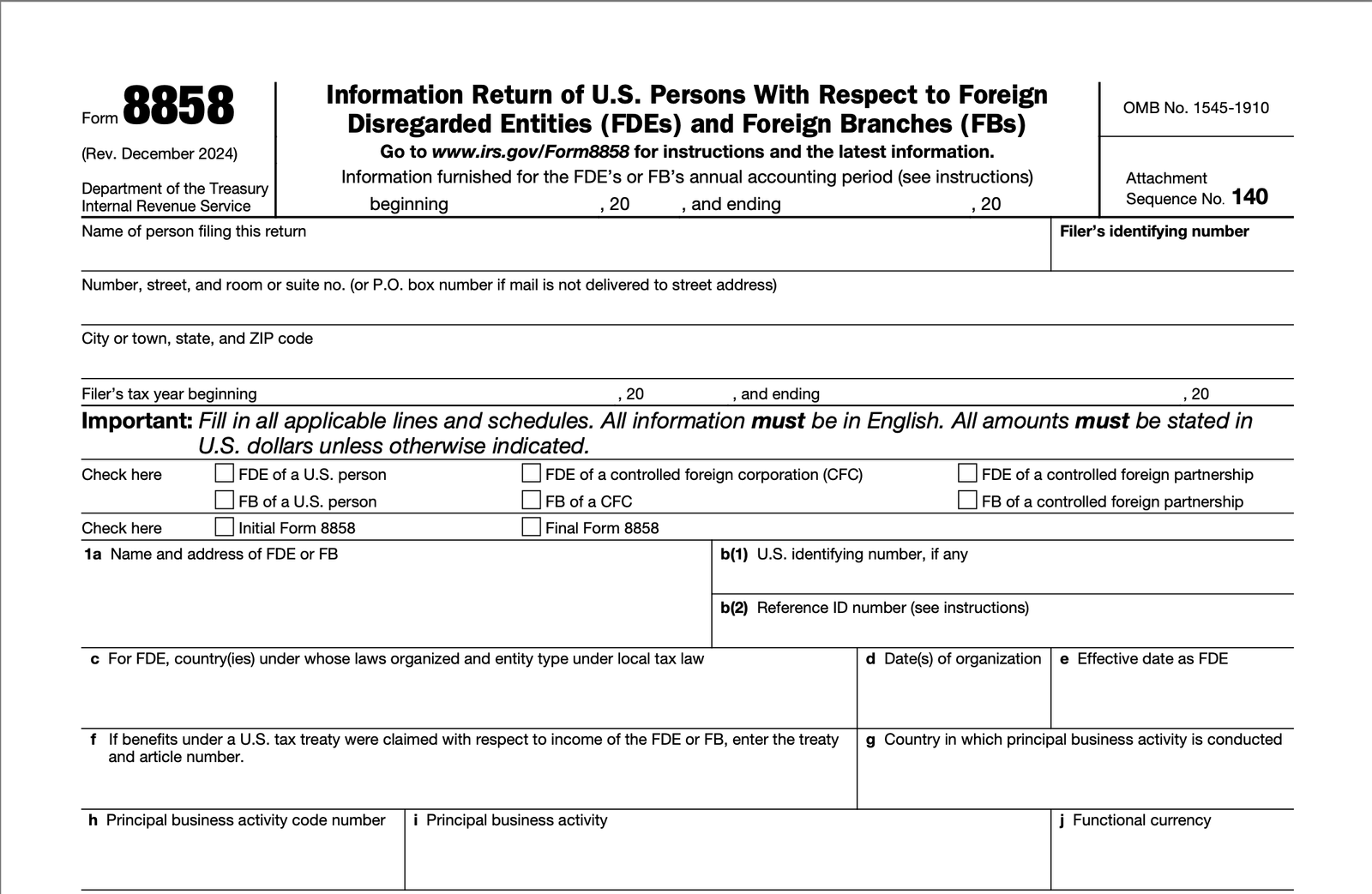

What Is Form 8865?

Form 8865 is a US tax form required by the IRS for individuals and businesses with an interest in the partnership of a foreign entity. It reports:

- Ownership stakes and proportional interests

- Contributions and distributions

- Income, expenses, and the balance sheet of the foreign partnership

- Transactions between the partnership and the US person

The form is similar to Form 1065 for US partnerships but applies to foreign entities. Filing ensures transparency and prevents tax evasion.

Even if you don’t receive any income from the partnership, you may still need to file Form 8865!

Who Needs to File Form 8865?

The IRS requires different people to file based on their involvement in the foreign partnership. There are four main categories of filers:

Category 1 Filer: Controlling Partners

- Who: US persons owning more than 50% of the partnership at any point during the year.

- Example: You and another US partner control 60% of the foreign partnership.

- Filing Requirement: File Form 8865 with all applicable schedules.

Category 2 Filer: Significant Partners in Controlled Foreign Partnerships

- Who: US persons owning at least 10% of a controlled foreign partnership (over 50% owned by US persons).

- Example: You hold a 12% interest in the partnership while other US taxpayers hold a combined 45%.

- Filing Requirement: File unless a Category 1 filer already submitted Form 8865.

Category 3 Filer: Person Who Contributed Property

- Who: US persons contributing property when: Ownership reaches 10% or more after the contribution, OR , the property contribution value exceeds $100,000.

- Example: You transfer equipment worth $150,000 to a foreign partnership.

- Filing Requirement: Report the contribution on Form 8865.

Category 4 Filer: Dispositions and Changes in Interest

- Who? US persons that: Acquire or dispose of at least a 10% interest in the partnership, OR , experience a 10% or more change in ownership.

- Example: You sell part of your foreign partnership stake, dropping from 15% to 4%.

- Filing Requirement: Submit Form 8865 with transaction details.

Pro Tip:Even if you don’t receive any income from the partnership, you may still need to file Form 8865.

Why Filing Form 8865 Matters

Failing to meet filing requirements can lead to severe penalties, including fines and potential criminal penalties. Here’s why filing it’s critical:

✓ Stay compliant with US tax laws

✓ Avoid additional penalties starting at $10,000 per form

✓ Prevent audits and IRS scrutiny

✓ Maintain eligibility for foreign tax credits

✓ Bottom line: Filing Form 8865 protects you from unnecessary financial risks.

When Is Form 8865 Due?

Form 8865 is filed with your income tax return:

- Individuals: April 15 (or October 15 with an extension)

- Corporations/Partnerships: With their respective filing deadlines

Late filings automatically trigger penalties. Don’t miss the deadline!

How to File Form 8865 (Step-by-Step Guide)

✓ Step 1: Determine Your Filing Category

Knowing your category of filer is crucial. It dictates which Form 8865 schedules you must complete.

✓ Step 2: Collect Required Information

- Financial statements of the foreign partnership

- Details of any property contributions

- Transaction records between you and the partnership

- Ownership structure documents and the balance sheet

✓ Step 3: Complete Necessary Schedules

- Schedule K-1 Equivalent: Shows your share of income and expenses

- Schedule G: Reports transactions with the partnership

- Schedule O: Provides organizational details

- Schedule M: Discloses related-party transactions

✓ Step 4: Keep Documentation

Another important thing is to keep all record because the IRS can audit you several years later!

Common Mistakes to Avoid

⊗ Misreporting Proportional Interests: Always check indirect ownership stakes.

⊗ Late Filing: Results in additional penalties and possible criminal penalties.

⊗ Incomplete Form 8865 Schedules: Missing schedules can void your filing.

⊗ Assuming Another Partner Filed: Verify submissions to avoid surprises.

⊗ Overlooking Minor Interests: Small stakes can still require filing.

Tip: When in doubt, consult a tax professional or file proactively.

What If You Don’t File Form 8865?

Penalties can add up quickly!

$10,000 per missed form

Up to an additional penalty of $50,000 for continued non-compliance

10% penalty on contributions (capped at $100,000) for late Category 3 filings

Possible criminal penalties for willful non-compliance

Avoid these costs by filing accurately and on time!