Key Takeways

-

- Know the True Costs: Spanish property taxes (IBI), transfer taxes (ITP), and fees can add up to 15% of the purchase price. Always check a Nota Simple for debts and budget for legal, notary, and registry costs.

-

- Prepare Financially and Legally: Open a Spanish bank account, translate financial documents, and ensure compliance with U.S. and Spanish tax obligations, including FATCA and FBAR requirements.

- Protect Your Interests: Research neighborhoods thoroughly and work with independent advisors to avoid conflicts of interest with agents and ensure your property meets all legal and zoning requirements.

The Spanish real estate market operates very differently from the U.S. and unfamiliarity can lead to costly mistakes down the road. To help you through this process smoothly, we’ve highlighted the 7 most common pitfalls of buying property in Spain how to best avoid them.

1. Not Understanding Local Property Laws

Assuming Spanish property laws are the same as in the U.S. is a costly mistake. For example, property taxes, such as the Impuesto sobre Bienes Inmuebles (IBI), work differently. Rental regulations, particularly for short-term tourist rentals, are often restrictive and vary significantly by region.

-

- Property taxes: The Impuesto sobre Bienes Inmuebles (IBI) is an annual property tax in Spain that is imposed by local municipalities and based on the cadastral value of your property (determined by the public administration). The tax can range from 0.4 – 1.1% of the cadastral value depending on where in Spain you live.

- Rental Regulations: In regions such as Catalonia you must first get a tourist rental license (licencia de uso turístico) to legally be able to rent out your property to tourists. Additionally, some municipalities can have restrictions on the number of days per year that you can rent out your property to limit over-tourism. It’s always important to check with your local town hall (ayuntamiento) as to what those limits are if any.

How to Prepare for the Local Property Laws

✓ Ensure the property qualifies for a rental license in your region: Go to your local town hall (ayuntamiento) to confirm if the property you bought qualifies for a rental license. This is especially important to double-check since the requirements vary widely by region.

✓ Confirm the number of days you can rent out your property every year

✓ Know the Cadastral value of your property: Since the IBI property tax is based on the cadastral value of your property it’s important to be crystal clear on what amount this is. You can request the Cadastral value from the Catastro office.

✓ Regularly verify the rate of the IBI property tax: Since the IBI property tax differs from region to region and is subject to change over time it’s always important as an American looking to buy property in Spain to stay up to date with any changes as well as what the rate is in your specific region.

2. Underestimating Additional Costs

Many buyers focus solely on the purchase price, forgetting to account for additional costs like transfer taxes (ITP), notary fees, land registry expenses, and agent commissions.

These can add up to 10–15% of the property’s price. In other words, if you were to buy a house or apartment for EUR 500,000 in Spain the total additional costs could be between EUR 50,000 to EUR 75,000.

As a comparison to the US, total costs for buying a property (including application fees, appraisal, home inspection, originator/underwriting fees, insurance, and so forth) typically fall in the 2 – 5% range (with some exceptions). For Americans taking US property costs into account when buying a property in Spain can lead to unforeseen costs.

-

- ITP (Impuesto de Transmisiones Patrimoniales) or Transfer Taxes: These vary widely by region for resale properties. They can range from 6 – 10% of the purchase price.

-

- Notary Fees: To authenticate transactions involving property in Spain you must use a notary, i.e. it’s mandatory. Though regulated they tend to range between 0.5 – 1% of the value of the property.

-

- Land Registry Fees: These fees are related to registering a property with the land registry which is essential to confirm legal ownership. Such fees tend to range between 0.4 – 0.7%.

-

- Agent Commissions: These will typically be in the range of 3 – 6%. However, there are stories where people have been charged much more than the numbers in this range, so having a good idea of what you are paying is crucial.

How to Limit Additional Costs

✓ Ask for an itemized and detailed price breakdown from the notary and the land registry to stay prepared

✓ Clarify the Agent’s commissions early: Since the commissions that real estate agents in Spain charge can sometimes be sky-high, it’s important to ask for a detailed commission schedule from the agent before you start the process. This will ensure that you’re not getting scammed.

✓ Have someone provide a second opinion on the costs to see if they are reasonable and comparably competitive: It’s difficult to know what agents in Spain should charge, or what notary and land registry fees should be, therefore it’s advisable to work with someone who has local expertise and can provide a second opinion or advice in the process.

Does Buying Property in Spain Feel More Complicated Than You Expected?

Let Us Help You Avoid the Most Common Pitfalls!

Buying property in Spain as an American can feel overwhelming, but you don’t have to face it alone. We’ll help you:

- Understand the real costs, taxes and legal requirements.

- Find the perfect neighborhood for your family and lifestyle.

- Avoid costly mistakes with guidance at every step of the way.

3. Skipping Legal Checks on the Property

One of the riskiest mistakes is failing to verify that the property is free of debts, encumbrances, or legal issues. Some buyers only discover after the fact that there are irregularities with the property’s construction or even cases of illegal occupation. However, a much more common issue in for example Barcelona arises from the lack of thorough property due diligence, which can affect any property, regardless of price or type.

Practical Steps to Avoid These Costs

✓ Get a Nota Simple: An extract from the Property Registry (Registro de la Propiedad) that includes important information on the property you’re looking to buy such as the legal status, ownership details, and any charges or encumbrances. This extract can also confirm whether there are any legal disputes concerning the property.

✓ Review the Cadastral Info on the Property: It’s always worth double-checking that the physical characteristics of the property you’re looking to buy match that of the official records in the Cadastre. Look out for boundaries or built areas.

✓ Make sure the property has a Habitability Certificate (Cédula de Habitabilidad): Double check the Habitability Certificate to make sure that the property meets the minimum living standards that Spanish law requires.

✓ Confirm it complies with local planning regulations: Perhaps most important for properties in rural areas, always make sure that the property you’re looking to buy doesn’t conflict with any planning or local zoning laws. Otherwise, you might have to be responsible for any reconstructions to the property once you’re the new owner.

✓ Make sure there are no outstanding debts with the property: Since properties in Spain can carry debts in the form of mortgages and unpaid utility or community fees it’s always important to double-check what amounts these debts are in if any before you make the purchase.

✓ Unregistered Renovations: Every American who’s looking to buy property in Spain should also confirm that all renovations or modifications made to a property in the past have been registered legally, for unregistered renovations you could face legal complications which can potentially result in fines when you are the new owner of the property. To confirm whether past renovations have been registered you can get a copy of the Final Work Certificate (Certificado Final de Obra).

✓ Check the energy certificate of the property: As required by Spanish law, every property owner must have a valid energy certificate (Certificado de Eficiencia Energética) when they wish to sell or rent out their property.

4. Poor Financing Preparation

Buying a property in Spain often requires financing, but the process can be very different from securing a mortgage in the U.S. Many American buyers don’t realize they need to open a Spanish bank account or prepare extensive documentation to prove their financial standing before qualifying for a mortgage.

To open a bank account US Citizens will need to present a:

-

- Spanish NIE (Número de Identificación de Extranjero) which is mandatory for non-residents in Spain when engaging in any financial transactions.

-

- Proof of income: Recent paychecks, tax returns, or anything similar will typically suffice.

-

- Proof of address or utility bills

Mortgages in Spain for Americans

-

- Loan-to-Value (LTV): For non-resident Americans banks will often finance around 60 – 70% of the property value (sometimes even less) while residents typically enjoy up to 80% financing on the property value.

-

- Interest rates: Fixed ones are about 3.5% and above depending on your financial situation and variable rates are tied to the Euribor (or Euro Interbank Offered Rate).

How to Ensure Good Financial Preparation

✓ Translate all your US documents such as tax returns or paychecks (as proof of income), recent bank statements (as proof of sufficient funds), and all other official personal identification and tax residency documents to Spanish before you apply for a mortgage. Additionally, it’s smart to also keep your credit history and rating handy and have this translated into Spanish. Doing so will most certainly reduce the time that the process will take and lead to less trouble in the end.

5. Overlooking Neighborhood Research

Barcelona’s charm lies in its diversity of neighborhoods, each with its own character. However, failing to research the area thoroughly can lead to regrets. You might buy a property in a tourist hotspot thinking it’s peaceful, or choose a location far from essential amenities. Present in Barcelona since 1998, we know each and every district in town and can guide you to find the perfect neighborhood that fits your lifestyle.

Practical Steps in Finding a Suitable Neighbourhood

✓ Price knowledge: Do your own research first using apps like Idealista or Fotocasa to get a feeling of what purchase or rent prices are in the different regions of the city.

✓ Visit the city before buying: As a general rule of thumb you should always visit a city before buying property in it. Explore the different areas and see what fits you.

✓ Work with a local partner: It will require many visits to a city for you to have the knowledge that people who live there have. It’s very easy to fall into the tourist trap by living in a tourist district and then end up buying property there which might turn out to be a huge mistake in the end.

6. Relying Solely on Real Estate Agents

In the US, agents often represent the buyer’s interests. In Spain, however, agents usually work for both the buyer and the seller—or solely for the seller which can create conflicts of interest.

What can you do instead?

✓ Make sure someone’s protecting your interests (the buyer): With Spanish real estate agents often working for both the buyer and seller or only the seller, there’s an obvious conflict of interest and incentive to get the price of the property to the highest level possible or simply to sell a property quick. This makes it especially important for Americans who are looking to buy property in Spain to work with someone who can protect their interests, i.e. the buyer’s.

7. Ignoring International Tax Implications

Owning property in Spain comes with Spanish tax obligations and potentially also in the U.S. Failing to understand these responsibilities can lead to legal or financial complications.

Spanish Tax Obligations that American property owners in Spain should be aware of:

-

- The Non-Resident Income Tax (IRNR): Non-residents (EU residents) pay 19% while non-residents (Non-EU residents) which is likely the case for US citizens pay 24% on potential rental income.

-

- Wealth Tax (Impuesto sobre el Patrimonio): This tax will be applied to properties whose value exceeds EUR 700,000. Non-residents in Spain must declare their assets in the country. If you are a tax resident in Spain you might also be required to file Form 720 (Declaración Informativa Sobre Bienes y Derechos Situados en el Extranjero) and declare your worldwide assets. Wealth taxes in Spain differ widely by region and the value of your assets but will typically be in the range of 0.2 – 3.5%.

-

- Capital Gains Tax (Impuesto m sobre las Plusvalías): If you sell property in Spain you will have to file a capital gains tax which will be in the range of 19 – 28%.

US Tax Obligations that every American Buying Property in Spain should be aware of:

-

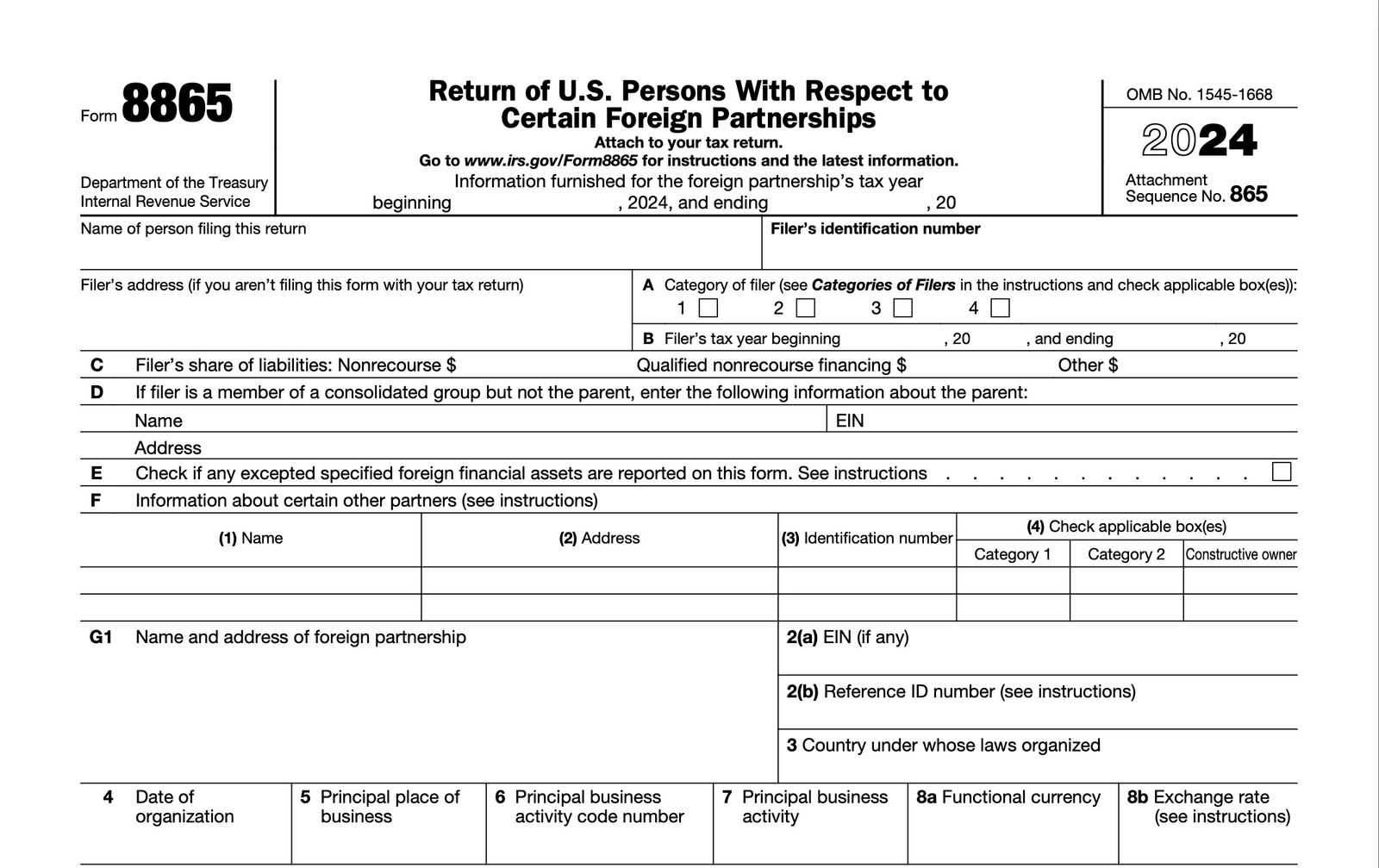

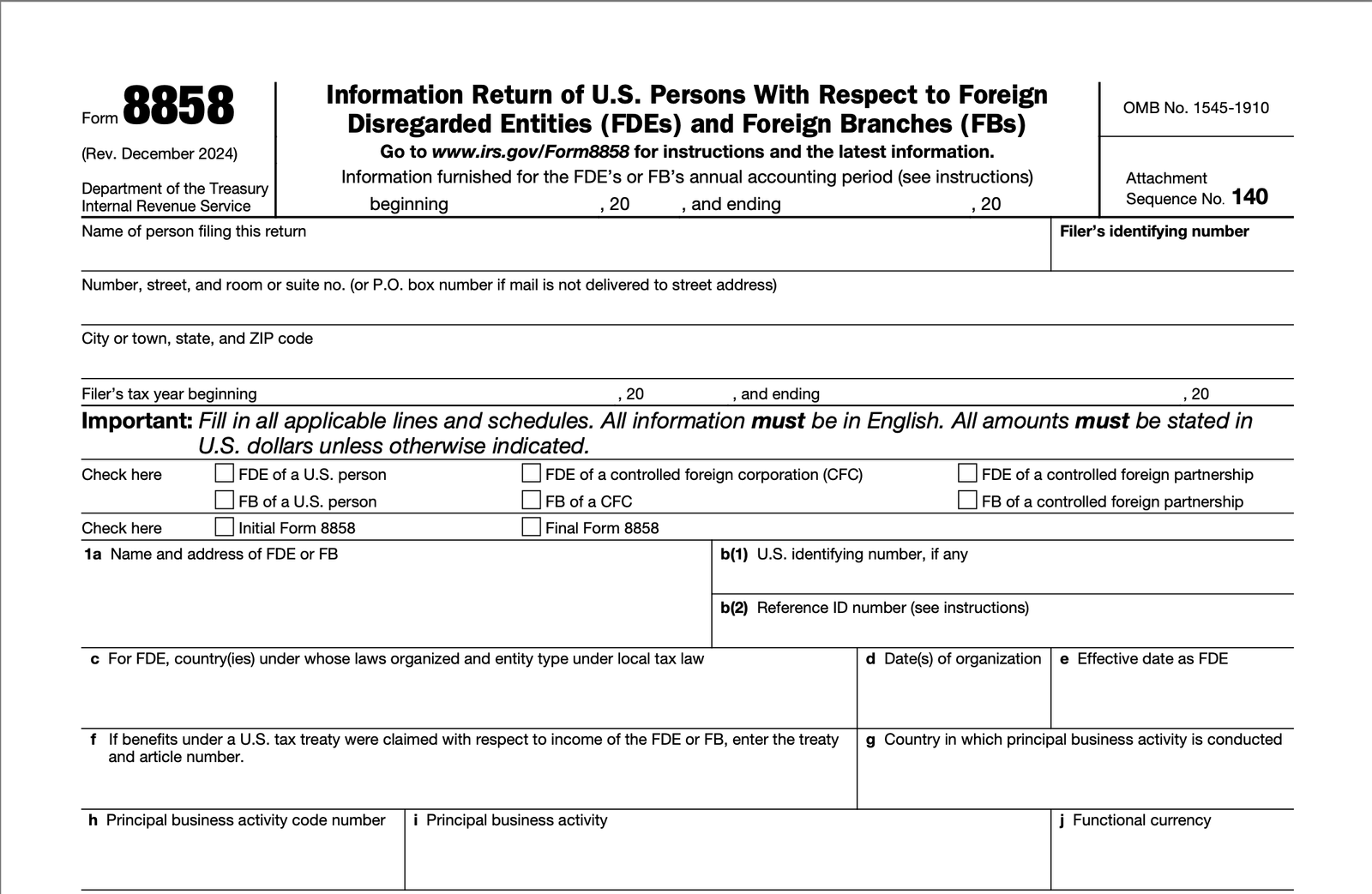

- FATCA compliance: All US citizens are required to report foreign property with Form 8938 under FATCA (Foreign Account Tax Compliance Act). A higher threshold usually applies for taxpayers living abroad.

-

- FBAR filing: All US citizens are required to report foreign financial accounts exceeding $10,000 with FinCEN Form 114. These accounts include but are not limited to bank accounts, brokerage accounts, and investments.

-

- Worldwide income: What makes things more complicated as a US citizen in particular is that you are obligated to file a tax return on your worldwide income.

Practical Steps to Be Compliant with Your Tax Obligations as an American Property Owner in Spain

✓ Understand the double taxation treaties between the US and Spain: There are tax treaties to prevent double taxation between the US and Spain, meaning that some taxes paid in Spain can be credited against your US tax obligations. Knowing which taxes qualify for credits and how they affect your liability in both countries is absolutely critical.

✓ Know Your Tax Residency: If you spend more than 183 days in Spain within a calendar year, you will probably be considered a Spanish tax resident. This means you would be required to report your worldwide income to Spanish authorities and might need to submit Form 720 which declares your foreign assets.

✓ Register for a Spanish Tax Identification Number (NIE): As a property owner in Spain, you need a Número de Identificación de Extranjero (NIE). This is required for paying Spanish taxes, buying or selling property and engaging in any financial transactions.

✓ Report Your Foreign Property and Financial Accounts to US Authorities: If your total foreign assets exceed the IRS threshold you must report them with Form 8938 (FATCA). Additionally, if you have financial accounts exceeding $10,000 at any point in the year, you must report and file this in FinCEN Form 114 (FBAR).

✓ Track and Declare Your Worldwide Income: As a US citizen, you are required to report your global income, including rental income from your Spanish property, even if you already pay Spanish taxes on it. This must be included on your US tax return, typically on Schedule E (Supplemental Income and Loss).

✓ Keep Records of Expenses and Tax Payments: Maintain records of Spanish tax payments, deductible property expenses and proof of residency status. This will help you claim foreign tax credits and avoid penalties as well as any other problems down the road.

✓ Work with an expert who understands how these cross-border laws affect Americans: The complexity of cross-border taxation means working with a specialist in U.S.-Spain tax law is highly recommended. A professional can guide you through tax-efficient structuring, compliance requirements, and filing procedures to avoid costly mistakes.

Does Buying Property in Spain Feel More Complicated Than You Expected?

Let Us Help You Avoid the Most Common Pitfalls!

Buying property in Spain as an American can feel overwhelming, but you don’t have to face it alone. We’ll help you:

- Understand the real costs, taxes and legal requirements.

- Find the perfect neighborhood for your family and lifestyle.

- Avoid costly mistakes with guidance at every step of the way.

About the Co-Author: Raik Seifert from Engel & Völkers (E&V)

Raik Seifert is a seasoned expert in the Barcelona real estate market, with a deep understanding of the city’s diverse neighborhoods and their unique characteristics. With years of experience helping clients navigate the complexities of buying property in Spain, Raik specializes in identifying homes that align perfectly with each buyer’s lifestyle and priorities. As part of Engel & Völkers, he leverages a client-focused structure that assigns one consultant to the property and another to the buyer, ensuring transparency and peace of mind throughout the process. His commitment to thorough due diligence and personalized service helps buyers avoid common pitfalls, from legal compliance to finding the right neighborhood for their needs.