Forming Businesses and Building Legacies

For Americans in Europe

Lancier Global helps U.S. citizens establish a robust, cost- and tax-efficient foundation for their entrepreneurial ventures in Europe & beyond. With cross-border expertise and tailored solutions, we set up your business, trust, or foundation for lasting success and full compliance with local and U.S. regulations.

Business Structuring Solutions

We support U.S. citizens in establishing a solid foundation for their entrepreneurial and personal goals in Europe. Whether you’re launching a new business, creating a tax-efficient holding company, or establishing a legacy foundation, our Company Formation service simplifies the complexities of cross-border setup. With expertise in local European regulations and an understanding of U.S. compliance requirements, we bridge the gap to ensure your business, trust, or foundation operates smoothly and compliantly.

At A

Glance

For U.S. citizens, incorporating a business in Europe presents unique opportunities but also challenges when it comes to taxation and regulations. Establishing a European entity can give access to 27 EU member states, allowing American business owners to reduce operational costs and streamline taxes. However, the complex regulatory requirements of both European jurisdictions and U.S. tax laws is critical. Without the right structure and compliance measures, U.S. citizens risk facing double taxation, IRS penalties, and banking restrictions due to FATCA (Foreign Account Tax Compliance Act). At Lancier Global, we simplify the company formation process for U.S. citizens, ensuring full compliance with local European laws and IRS reporting obligations.

Why Start a Business in Europe as a U.S. Citizen?

Europe is one of the most attractive destinations for U.S. entrepreneurs due to its favorable business environment and access to a large consumer market.

Key Benefits of Forming a Company in Europe as a US Citizen

- Tax Optimization: Leverage double-taxation treaties to reduce your global tax burden.

- Access to EU Markets: Gain unrestricted access to 27 EU member states, opening doors to new clients and partners.

- Asset Protection: Establish holding companies or subsidiaries to separate personal assets from business liabilities.

- Reduced Operational Costs: Many European countries offer low corporate tax rates and cost-effective incorporation processes.

Popular European Jurisdictions for U.S. Citizens Starting a Business

Choosing the right European jurisdiction is essential for tax planning, business growth, and long-term success. Below are some of the most popular destinations for U.S. entrepreneurs:

Cyprus

Corporate Tax Rate: 12.5%

Benefits: Simple incorporation process, double-taxation treaty with the U.S., and a cost-effective location for holding companies.

Ireland

Corporate Tax Rate: 12.5% on active business income.

Benefits: English-speaking workforce, strong U.S. ties, and an attractive holding company regime for investment structures.

Switzerland

Corporate Tax Rate: Varies by canton (average around 15%).

Benefits: Known for financial stability, privacy protections, and robust legal frameworks, making it a top choice for high-net-worth individuals.

Other countries like Malta, Portugal, and Germany also offer unique advantages depending on your business goals.

Challenges U.S. Citizens Face When Starting a Business in Europe

Despite the many benefits, starting a business in Europe comes with unique challenges for U.S. citizens, particularly related to tax compliance and banking regulations.

FATCA Compliance & Banking Restrictions

Due to FATCA, many European banks are reluctant to work with U.S. citizens because of the reporting burdenimposed by the IRS. This can make opening a bank account for your European business more challenging. Our team helps clients navigate FATCA compliance and connect with FATCA-friendly banks to ensure smooth financial operations.

Double Taxation Risks

As a U.S. citizen, you’re taxed on your worldwide income, even if you operate a business abroad. Without the right tax planning, you risk being double-taxed in both the U.S. and your European jurisdiction. We leverage double-taxation treaties to minimize your global tax liability and help you choose the best entity classification to optimize taxes.

IRS Reporting Requirements for U.S. Citizens Starting a Business in Europe

When a U.S. citizen establishes a foreign business, several IRS forms must be filed to remain compliant:

- Form 5471: Required if you own 10% or more of a foreign corporation.

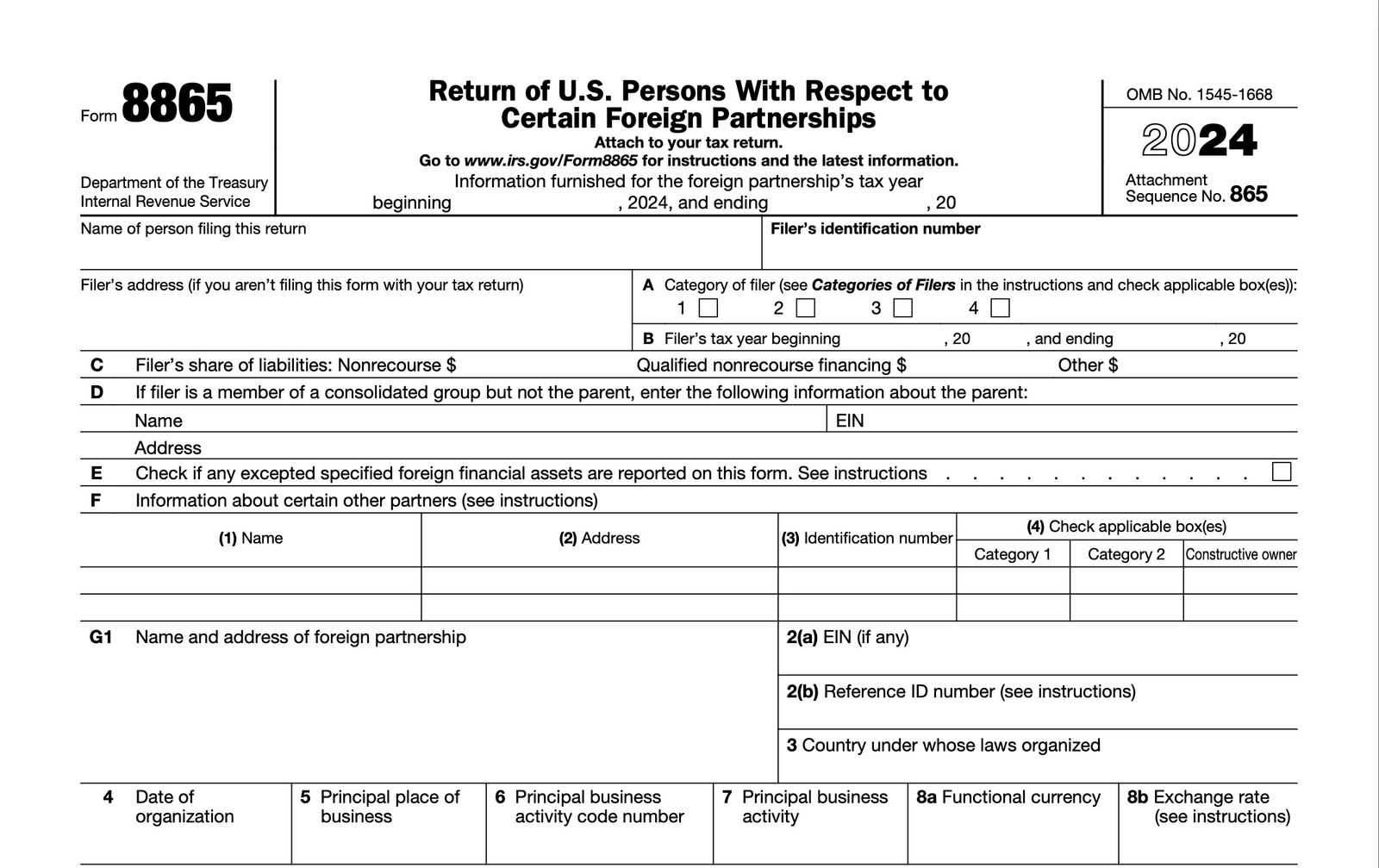

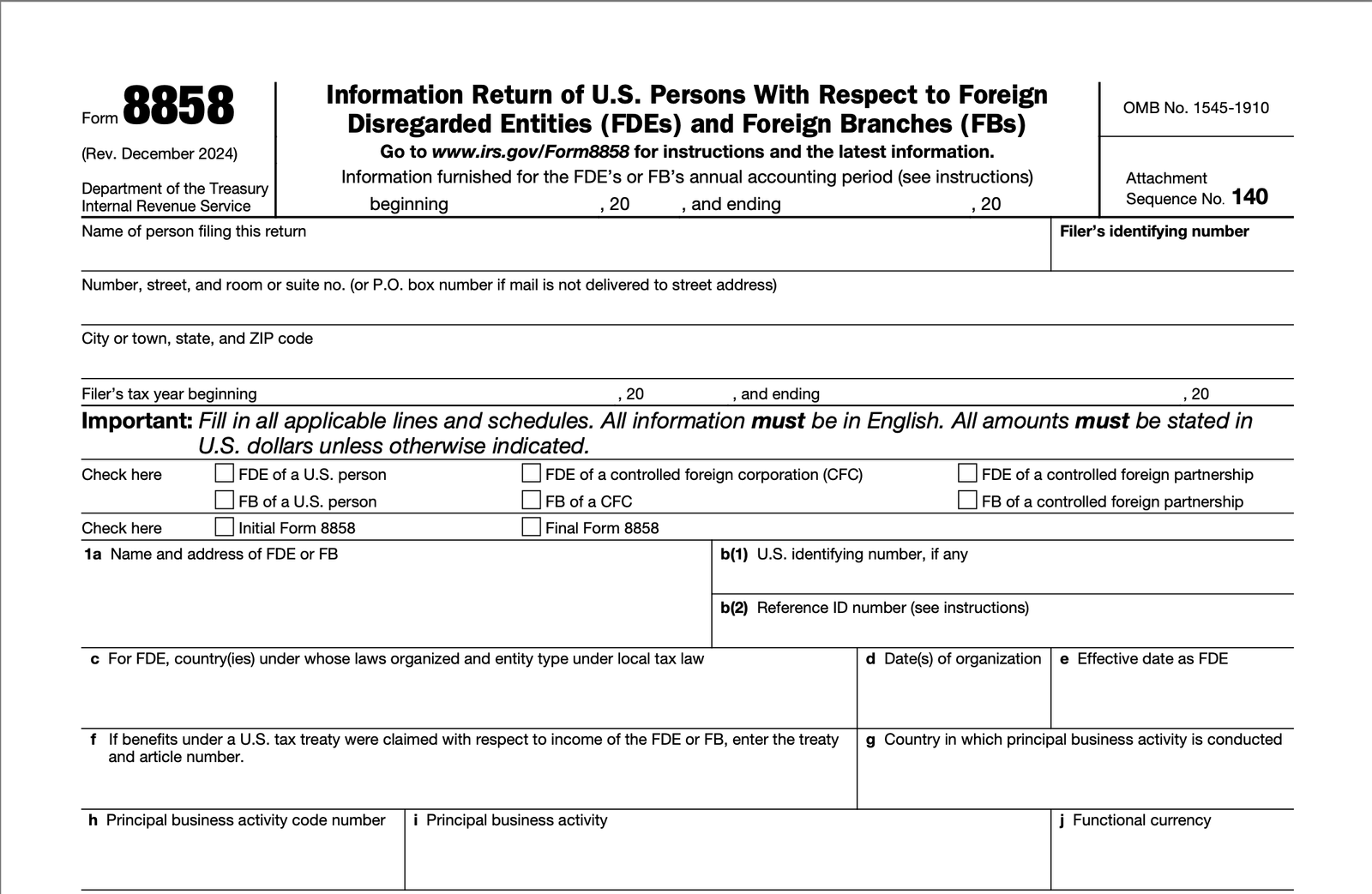

- Form 8865: Required if your European entity is a partnership.

- Form 8832: Used to elect your entity classification (e.g., C-Corp, S-Corp, or partnership) for U.S. tax purposes.

- FBAR (Foreign Bank Account Report): Must be filed annually if your foreign bank accounts exceed $10,000.

- FATCA Reporting: Required if your foreign assets exceed $50,000.

Failure to file these forms can result in severe penalties, including fines of up to $10,000 per form.

How Lancier Helps U.S. Citizens Form a Company in Europe

Our Company Formation Services ensure U.S. citizens can start their European businesses quickly, efficiently, and with full compliance.

- Entity Selection: We help you choose the best jurisdiction and business structure based on your goals and tax planning needs.

- Company Registration: We handle the entire incorporation process, including name reservation, articles of association, and bank account setup.

- Tax Planning & Compliance: We ensure your European business complies with local tax laws and U.S. reporting requirements, including FATCA, FBAR, Form 5471, and Form 8865.

- Ongoing Administration: We provide ongoing support, including annual filings, tax reporting, and regulatory updates, ensuring your business remains compliant in both Europe and the U.S.

Common Questions U.S. Citizens Have About Starting a Business in Europe

Can a U.S. citizen open a business in Europe?

Yes. U.S. citizens can open businesses in European countries, but they must comply with local regulations and IRS reporting requirements.

Do I need to report my foreign business to the IRS?

Yes. U.S. citizens must report ownership in foreign entities by filing Form 5471, Form 8865, or Form 8832, depending on the business structure.

How do I avoid double taxation when starting a business in Europe?

By leveraging double-taxation treaties and selecting the right entity classification, you can minimize your tax liability.

For U.S. business owners looking to move their existing company to Europe, the process involves more than just transferring operations. It requires careful planning to address cross-border compliance, double-taxation risks, and U.S. tax obligations. Moving a company can be a smart strategy for tax optimization, asset protection, and market expansion, but it also involves navigating local European regulations and ensuring compliance with IRS reporting requirements.

Our Business Relocation service simplifies this process for U.S. citizens, ensuring a smooth transition and full compliance with both European laws and U.S. tax obligations.

Why Move Your Business to Europe?

Relocating a U.S. company to Europe offers several advantages, including:

Jurisdictions such as Cyprus, Ireland, and Switzerland offer favorable corporate tax rates and double-taxation treaties that help reduce your overall tax liability.

Establishing a European entity provides access to the entire EU market, allowing American companies to operate across 27 EU member states without additional restrictions.

Common Forms To Keep in Mind

U.S. citizens must address several critical compliance requirements when relocating or incorporating a business abroad:

- Form 5471: If you hold 10% or more ownership in the relocated entity, you must file this form with the IRS to report your foreign corporation.

- Form 8865: If the relocated entity is classified as a foreign partnership, this form must be submitted.

- Form 8832: If the relocated entity needs a specific tax classification, this form must be filed to determine whether it will be taxed as a C-Corp, S-Corp, or partnership under U.S. tax law.

Additionally, if your company holds foreign bank accounts, you must comply with FBAR (Foreign Bank Account Reporting) requirements and disclose any foreign financial accounts exceeding $10,000 via Form 114. FATCA compliance is also mandatory, requiring U.S. citizens to report global assets and foreign income.

Common Challenges for U.S. Citizens Moving a Business to Europe

Relocating a U.S.-based company to Europe involves several key challenges:

- Double Taxation Risks: Without proper planning, U.S. citizens may face double taxation on both foreign earnings and U.S. income. Leveraging double-taxation treaties is essential to avoid this.

- Entity Classification Issues: The IRS may classify your European entity differently from local laws. For example, a GmbH in Switzerland may be treated as a C-Corp for U.S. tax purposes, affecting your overall tax liability.

- Ongoing Compliance: U.S. citizens must meet annual reporting requirements for their foreign companies, including FATCA, FBAR, and filing Forms 5471, 8865, and 8832. Failure to comply can result in significant penalties.

How We Help U.S. Citizens Relocate Their Business to Europe

- Restructuring your U.S. business into a European entity that complies with both local laws and U.S. tax obligations.

- Ensuring your business meets FATCA, FBAR, and other IRS reporting requirements.

- Addressing double taxation risks by leveraging double-taxation treaties between the U.S. and European countries.

- Ongoing administrative service to keep your European entity compliant with both U.S. and European regulations.

For U.S. citizens managing assets across borders, establishing trusts and foundations in Europe can provide significant asset protection, tax efficiency, and legacy planning benefits. Whether you’re looking to safeguard personal wealth, establish a philanthropic foundation, or manage family assets for future generations, the right European structure ensures your wealth is protected, compliant, and sustainable.

At Lancier Global, we simplify the process of setting up trusts and foundations across key European jurisdictions like Switzerland, Cyprus, and Malta, ensuring that your cross-border structure complies with both U.S. tax laws and local European regulations.

Why U.S. Citizens Choose Trusts & Foundations in Europe

A trust or foundation offers U.S. expats and American entrepreneurs several advantages when managing wealth across borders:

- Asset Protection: Trusts and foundations separate legal ownership from beneficial ownership, protecting assets from creditors, litigation, and political risk.

- Tax Efficiency: Proper structuring of trusts can reduce estate taxes and optimize inheritance planning by leveraging double-taxation treaties.

- Legacy Planning: Trusts and foundations allow U.S. families to manage wealth across multiple generations, ensuring long-term financial security.

Unlike in the U.S., European jurisdictions like Switzerland and Cyprus offer strong privacy protections for trust and foundation structures, ensuring that your wealth remains confidential and secure.

Common Types of Trusts for U.S. Citizens in Europe

- Revocable Trusts: Allow the grantor to modify or terminate the trust at any time. Commonly used for estate planning and asset management.

- Irrevocable Trusts: Cannot be modified once established. Ideal for tax planning and asset protection.

- Charitable Trusts: Used to support philanthropic goals while providing tax benefits.

- Foundations: Similar to trusts but offer greater control over assets and are often used for family legacy planning.

When setting up any of these structures, U.S. citizens must remain compliant with IRS reporting requirements.

Key IRS Reporting Requirements for U.S. Citizens Setting Up Trusts Abroad

When a U.S. citizen establishes a foreign trust or foundation, several IRS forms must be filed to avoid penalties:

- Form 3520: Used to report foreign trusts and gifts. U.S. citizens must file this form if they create, transfer assets to, or receive distributions from a foreign trust.

- Form 3520-A: This form must be filed annually by foreign trusts with U.S. owners to provide a detailed accounting of trust income and distributions.

- FBAR (Foreign Bank Account Report): If the trust holds foreign financial accounts exceeding $10,000, the U.S. person must report these accounts to the U.S. Treasury Department via Form 114.

- FATCA Reporting: The Foreign Account Tax Compliance Act requires U.S. citizens to report foreign financial assets over a certain threshold. Trusts and foundations with foreign accounts fall under this requirement.

Failure to comply with these forms can result in severe penalties, including fines of up to $10,000 per form.

Popular European Jurisdictions for Trusts & Foundations

We help U.S. citizens establish trusts and foundations in the most favorable European jurisdictions, each offering unique advantages:

Switzerland: Known for its strong privacy protections and robust legal framework, Switzerland is a top choice for asset protection and wealth management.

Cyprus: Offers cost-effective trust structures and favorable tax treaties with the U.S. Ideal for U.S. families looking to protect cross-border assets.

Malta: A leading jurisdiction for foundations and philanthropic planning, with favorable tax benefits for U.S. citizens.

Benefits of Establishing a Trust or Foundation in Europe

Asset Protection: Protect your wealth from creditors, lawsuits, and political risk by transferring ownership to a trust or foundation.

Tax Optimization: Reduce estate taxes and take advantage of double-taxation treaties to avoid double taxationon your wealth.

Privacy: European jurisdictions like Switzerland offer strong privacy protections, ensuring your wealth remains confidential.

Legacy Planning: Manage wealth across multiple generations by setting up a family foundation or trust to ensure long-term financial security.

How We Help U.S. Citizens Set Up Trusts & Foundations Our Trusts & Foundations service includes:

- Jurisdiction Selection: We help you choose the best European jurisdiction based on your goals, whether it’s asset protection, philanthropic planning, or family legacy management.

- Trust or Foundation Setup: We handle the entire registration process, including drafting the trust deed or foundation charter, opening bank accounts, and ensuring compliance with local laws.

- IRS Compliance: We assist with filing the necessary IRS forms, including Form 3520, Form 3520-A, FBAR, and FATCA reporting.

- Ongoing Support: We provide ongoing administration, including annual filings, tax reporting, and compliance updates, to ensure your trust or foundation remains compliant.

For private U.S. citizens or business owners in Europe, setting up the right banking infrastructure is essential to managing cross-border transactions, multi-currency accounts, and regulatory compliance. However, the European banking system can be challenging because of global reporting obligations like FATCA and FBAR, along with local banking regulations that vary across jurisdictions.

Our Banking Solutions service helps U.S. expats and entrepreneurs establish secure and compliant banking arrangements in Europe, ensuring their financial operations run smoothly while meeting U.S. tax obligations.

Why U.S. Citizens Need A European Banking Solutions

U.S. citizens and companies alike often face many challenges when opening bank accounts in Europe. Due to FATCA (Foreign Account Tax Compliance Act), many European banks are cautious when it comes to accepting U.S. clients, as they must report account information to the IRS which brings an operation hurdle for the bank.

Common banking needs for U.S. citizens in Europe include:

- Multi-Currency Accounts: To manage cross-border transactions and reduce currency conversion fees.

- Merchant Accounts: For business owners accepting international payments.

- FATCA Compliance: Ensuring all foreign financial accounts are properly reported to the IRS.

- Access to Global Banking Networks: Providing seamless financial services across multiple jurisdictions.

Without the right banking setup, U.S. citizens risk facing double taxation, regulatory issues, and restricted access to banking services in Europe.

Key U.S. Tax Obligations for Foreign Bank Accounts

When opening bank accounts abroad, U.S. citizens must comply with several IRS reporting requirements, including:

- FBAR (Foreign Bank Account Report): Any U.S. citizen with foreign accounts exceeding $10,000 must file an FBAR (FinCen Form 114) annually with the U.S. Treasury Department.

- FATCA Reporting: The Foreign Account Tax Compliance Act requires U.S. taxpayers to report foreign financial assets over $50,000. Foreign banks holding U.S. client accounts are also required to report account details to the IRS.

Failure to comply with these requirements can result in substantial penalties, including fines of up to $10,000 per violation.

Our team ensures that your European banking setup meets all U.S. reporting obligations, reducing the risk of penalties and ensuring your accounts remain compliant.

Challenges U.S. Citizens Face with European Banks

Due to FATCA compliance requirements, European banks are often reluctant to accept U.S. clients. Some of the common challenges include:

- Account Rejections: Many European banks prefer not to deal with U.S. citizens due to the FATCA reporting burden.

- High Compliance Requirements: Banks require extensive documentation to ensure the account holder is FATCA-compliant.

- Limited Access to Merchant Services: U.S. businesses operating in Europe may struggle to secure merchant accounts for receiving payments.

Our Banking Solutions service helps overcome these challenges by connecting clients with FATCA-friendly banks and ensuring they meet all compliance requirements.

How We Help U.S. Citizens Open Bank Accounts in Europe

Our Banking Solutions service provides comprehensive support to ensure U.S. citizens can open and maintain European bank accounts without hassle:

- Bank Selection: We connect you with FATCA-compliant banks that offer multi-currency accounts, merchant services, and global banking solutions.

- Account Setup: We handle the entire account opening process, including documentation, due diligence, and KYC (Know Your Customer) checks.

- IRS Compliance: We ensure your foreign bank accounts meet FATCA and FBAR reporting requirements, reducing the risk of penalties.

- Ongoing Support: Our team provides ongoing assistance with account management, tax reporting, and compliance updates to ensure your banking setup remains secure and compliant.