Key Takeaways

- Do Americans living abroad pay taxes? Yes, US citizens must file taxes on worldwide income, but tax breaks can reduce what you owe.

- How much tax do Americans abroad pay? Many qualify for exclusions and credits that lower or eliminate US tax obligations depending on your income.

- What tax forms do expats need to know? Key forms include Form 2555 for income exclusion, Form 1116 for foreign tax credits, and FBAR for foreign bank accounts.

Living abroad sounds like a dream for many people, with new cultures, new experiences and often a lower cost of living.

But if you’re a US citizen, one thing never change…

Taxes!

The US is one of the few countries in the world that taxes its citizens no matter where they live in the world. That means whether you’re working in Europe, retiring in Asia or running a business in South America, you will still have to deal with the IRS.

Taxes for Americans Living Abroad

US citizens and Green Card holders are required to file a tax return every year, reporting their worldwide income. This includes wages, self-employment income, rental income and even some foreign pensions.

If you earn over $14,600 as a single filer or $29,200 if filing jointly (2025 tax year), you must file a return just like if you lived in the U.S.

Even if you don’t owe anything, you still need to file. Failing to do so could lead to penalties and if you ever decide to move back to the US, not filing could cause problems with your financial records.

But don’t panic yet. There are ways to reduce or eliminate your US tax bill while living abroad.

Why Do Americans Have to Pay Taxes When Living Abroad?

Most countries tax based on residency, meaning you only pay taxes where you live and is registered.

However, the US taxes based on citizenship which means that no matter where you live, you’re still expected to report your income.

This system, known as citizenship-based taxation (CBT), has been debated for years, but for now, it remains the law. That’s why Americans working abroad pay taxes, even if they’ve been gone for decades.

However, some groups advocate for switching to a residence-based system. The Foreign Earned Income Exclusion and Foreign Tax Credit help ease the burden, but tax filing requirements remain a challenge for many expats.

How Much Tax Do Americans Living Abroad Pay?

How much you owe in taxes depends on many things:

- Foreign Tax Credits (FTC) – If you pay taxes in your country of residence, you may be able to offset your US tax bill dollar-for-dollar.

- Foreign Earned Income Exclusion (FEIE) – This allows you to exclude up to $120,000 (2023) of foreign-earned income from U.S. taxes if you qualify.

- Tax Treaties – The US has treaties with many countries to prevent double taxation.

- State Taxes – Even if you live abroad, some US states may still require you to file state taxes, depending on where you last lived.

In many cases, if you file properly, you may owe little to no US taxes at all.

But skipping filing altogether? That’s a different story.

The IRS has been cracking down on expats who fail to report their foreign income and assets.

What About Double Taxation When Living Abroad as a US citizen?

Many Americans abroad worry about double taxation, in other words paying taxes in both their country of residence and back in the states. While this is a concern, the US has mechanisms in place to prevent this from happening:

- Foreign Earned Income Exclusion (FEIE) – If you meet the physical presence or bona fide residence test, you can exclude up to $130,000 (in 2025) of foreign earned income from US taxation.

- Foreign Tax Credit (FTC) – If you’ve paid income tax abroad, you can use this to offset your taxes back in the states.

- Tax Treaties – There are agreements between the US and certain countries to avoid double taxation on income like pensions, social security and business earnings.

If structured properly, many Americans pay little to no US taxes while living overseas.

However, business owners or those with high investments may still have tax obligations even with these exclusions.

Tax Filing Deadlines for Americans Living Abroad

Expats get an automatic two-month extension on their filing deadline. Instead of the usual April 15th, your tax return is due June 15th. However, if you owe taxes, interest starts accruing from April 15th so it’s definitely best to file early.

You can also request an additional extension until October 15th if needed.

Also, if you have foreign financial accounts, you may need to file FBAR (Report of Foreign Bank Accounts), which is due on April 15th with an automatic extension to October 15th.

Missing deadlines could result in penalties, so keeping track of these dates is crucial.

If you need extra time, working with a tax professional can help ensure compliance while avoiding unnecessary fees.

Americans Filing Taxes While Working Abroad

If you’re earning money overseas, your tax situation sometimes involves additional forms. Some of the most common ones are:

- Form 2555 (Foreign Earned Income Exclusion) – If you qualify, this form allows you to exclude up to $120,000 of foreign-earned income.

- Form 1116 (Foreign Tax Credit) – If you pay foreign income taxes, this form helps prevent double taxation.

- Form 8938 (FATCA Reporting) – If you have foreign financial assets over a certain threshold, you must report them.

- FBAR (FinCEN Form 114) – If you have more than $10,000 in foreign bank accounts combined, you need to file an FBAR.

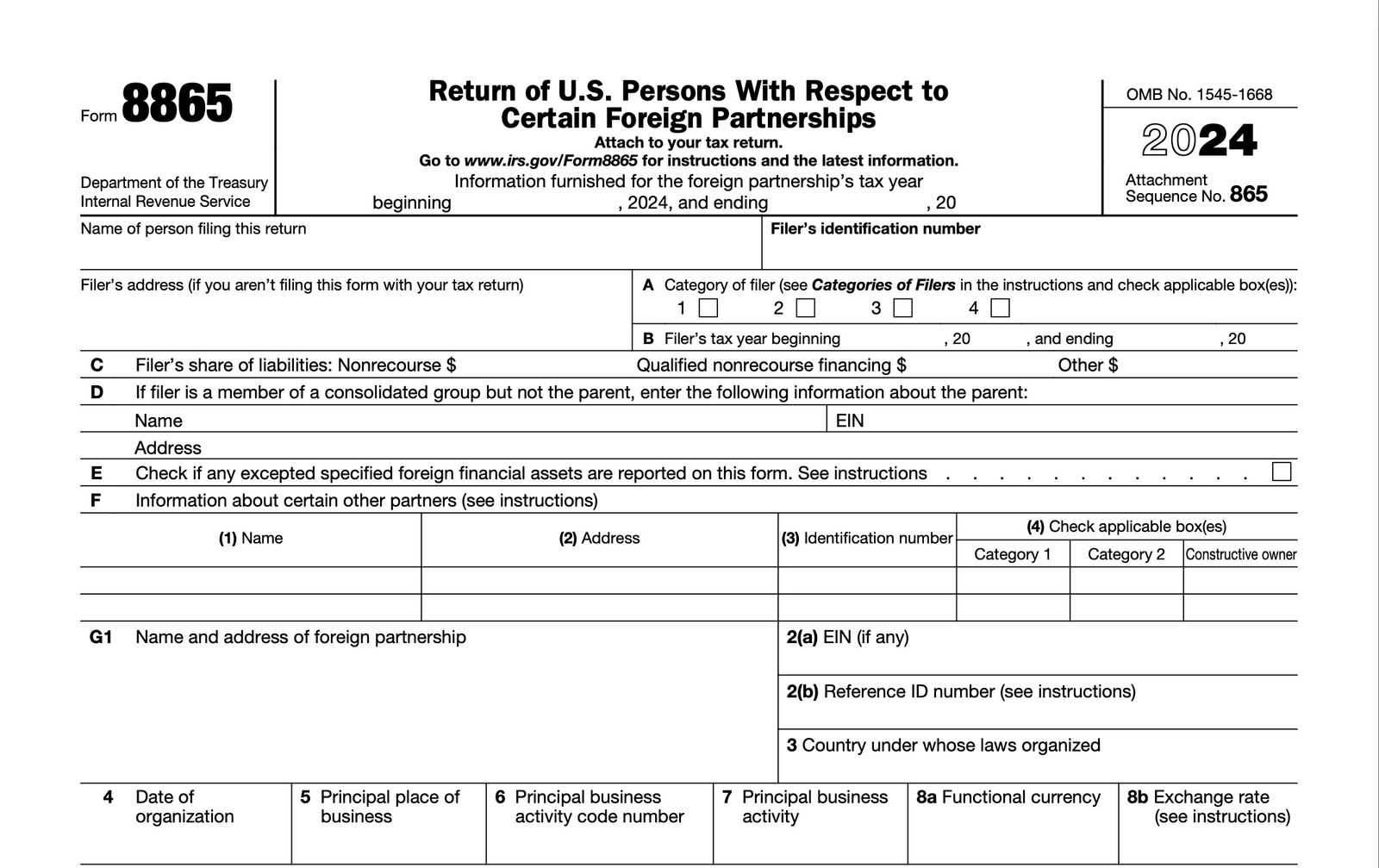

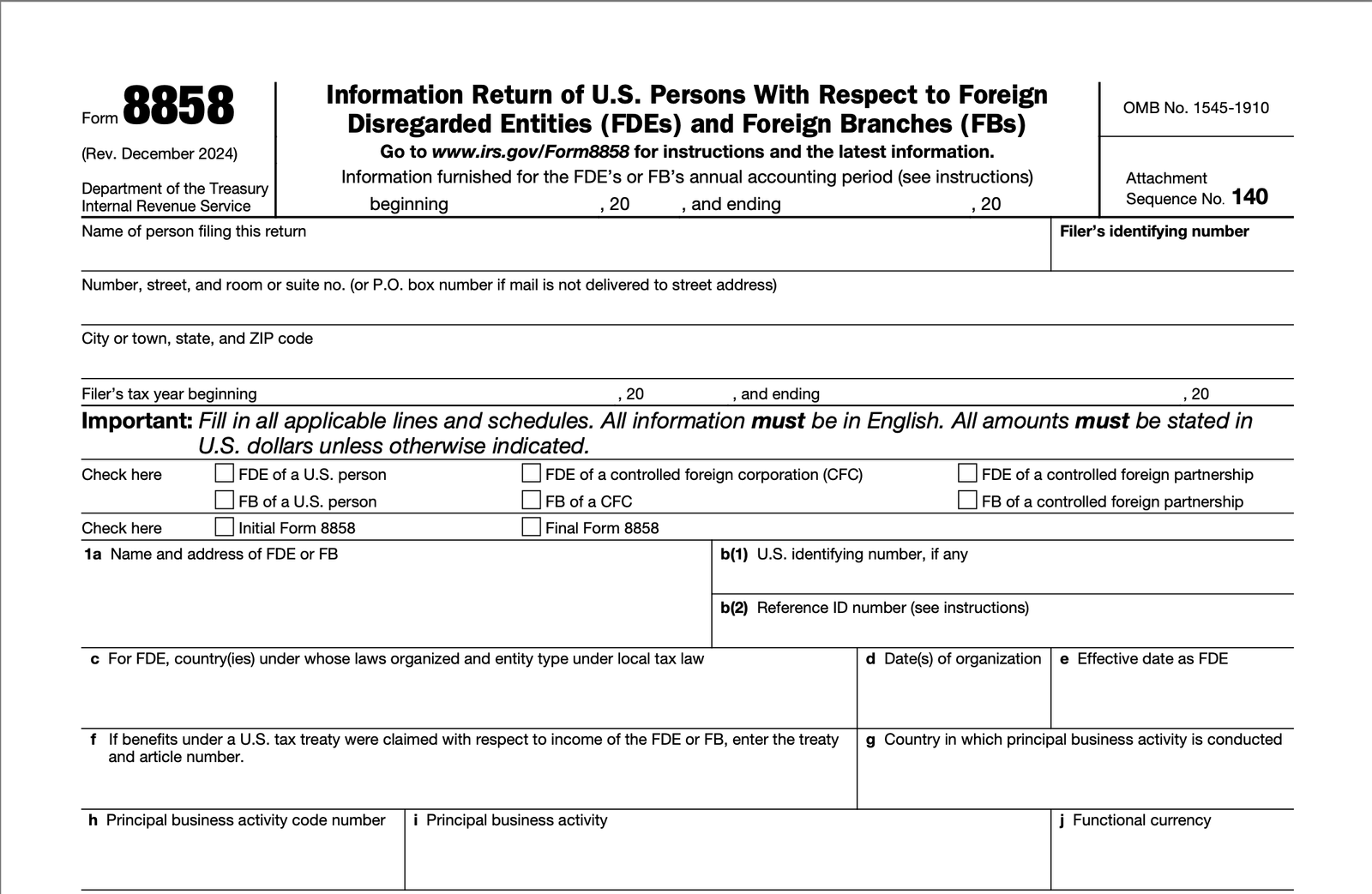

- Form 5471, Form 8865 and Form 8858 – These forms are required For Americans who own or have an interest in foreign corporations or partnerships.

For Americans with foreign businesses, things get even more complicated. You may need to work with an international tax expert to get a better grasp of your obligations.

Tax Breaks for Americans Abroad

There are many ways to lower your US tax bill while living abroad:

- Bona Fide Residence Test – If you’ve been a legal resident of a foreign country for an entire tax year, you may qualify for the Foreign Earned Income Exclusion.

- Physical Presence Test – If you’ve been outside the US for 330 full days in a 12-month period, you can also qualify for tax exclusions.

- Foreign Housing Exclusion – If you spend money on rent and utilities abroad, you may be able to deduct some of those costs.

Using these tools correctly can help reduce what you owe or even fully eliminate your tax bill altogether depending on what you earn.

Pro tip: Keeping track of your days abroad is crucial for meeting the Physical Presence Test and other tax breaks. There are many apps that help you keep track of travel dates automatically.

Final Thoughts

Americans still get taxed while living abroad, but there are many ways to reduce or even eliminate your tax bill.

The key is to file on time, claim all available exclusions and credits and stay compliant with foreign asset reporting.

Missing a filing deadline or forgetting a form can lead to steep penalties, so it’s worth getting it right.

Taxes for Americans abroad can feel overwhelming, but once you understand the basics, it’s much easier to manage.

Want to make sure you’re filing correctly?

Stay ahead of tax deadlines and avoid costly mistakes!

Filing taxes as a US citizen abroad can be complicated, but we make it easy by helping you:

- Understand key tax deadlines and requirements.

- Avoid common filing mistakes that could lead to penalties.

- Reduce or fully eliminate the taxes you have to pay in the states